How Many People Will Live in New Tashkent? Uzbekistan's Authorities Aim to Make the Metropolis Polycentric

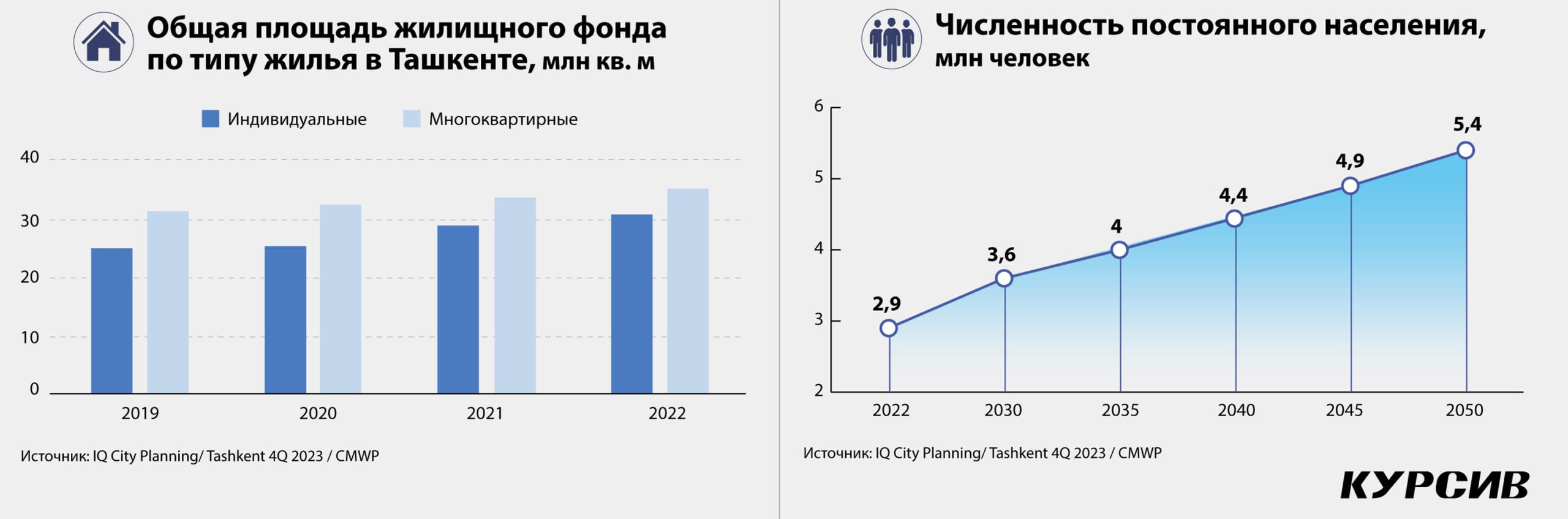

By 2035, Tashkent’s population is forecasted to grow by a quarter, reaching 4 million people, solidifying its status as the largest city in Central Asia. To transform the city into a polycentric metropolis, the government is creating a major business hub—New Tashkent. This initiative aims to reduce pressure on the city’s transport system while expanding the residential and commercial real estate stock.

With the inclusion of new districts, the housing stock in Uzbekistan’s capital could increase by 55% by 2035, while office real estate could expand by 460%, reaching 2.15 million square meters.

In its IQ City Planning Tashkent report, the international real estate consulting firm Commonwealth Partnership Uzbekistan (CMWP), formerly part of the global Cushman & Wakefield group, examines the current state of Tashkent and its development prospects for the next decade.

Urban Planning

Tashkent is set to become more polycentric under city administration plans. The capital is expanding eastward, with the Yangi Hayot district established in 2020. Preparations are underway for the New Tashkent project, located northeast of the metropolis, with implementation planned between 2023 and 2045.

Currently, more than one-third (35%) of the city’s total area is occupied by individual residential buildings. However, according to CMWP estimates, only 25% of the population lives in these structures. Most residents (62%) live in mid-rise housing, which occupies 12.3% of the city’s area. Industrial zones take up 16.8% of the city’s land, while commercial and office infrastructure accounts for just 4.7%.

New Tashkent is poised to become a new business hub. Plans for the 19,700-hectare area include relocating administrative offices and creating up to 200,000 jobs. Housing for 2 million people is planned, with the first phase featuring high-rise buildings for 100,000 residents. The district will also feature the "New Uzbekistan" University, a new National Library, a theater, and public spaces. Two metro lines will connect New Tashkent with the existing city. The relocation of government offices is expected to drive the area’s development.

"Creating a new business hub in the city could potentially reduce the load on the transport system and cut commuting times, which would positively impact the environment," the CMWP report states. However, it warns, "Delays in relocating administrative offices pose a risk, as they create the critical mass needed for a viable business district. Integrating New and Old Tashkent is crucial. Without a cohesive policy, this could lead to significant ecological, transport, and infrastructure challenges."

Key issues identified by experts include the profitability of business projects in the new area, specifically the demand from companies for remote spaces and the timeline for constructing residential properties needed to support business functions.

According to CMWP, the existing areas of the city also require government attention. In particular, industrial zones, about 40% of which are used inefficiently, and areas of individual private housing need redevelopment.

Opinion column by Temur Akhmedov: "We Are Building Tashkent, Not a Second Dubai"

Housing Development

As of July 1, 2023, Tashkent’s population was nearly 3 million, an increase of 43,100 people since the start of the year. Population growth is attributed partly to the influx of workers from across the country. CMWP forecasts that Tashkent will house 4 million residents by 2035 and 5.4 million by 2050.

The housing availability in Tashkent is 22.8 square meters per capita. However, private homes, housing about a third of the population, inflate the average. The city’s average residential density is 145 people per hectare, with an overall urban density of 68 people per hectare. The most densely populated areas include the city center, Chilanzar, Sergeli, and Yunusabad districts, with peak density in the Center-2 quarter at 1,480 people per hectare—comparable to cities like London, Hong Kong, and Milan.

The Tashkent-2030 development strategy aims to increase annual housing construction by 45% to 44,000 apartments, primarily outside the city’s ring road. In 2021, the New Uzbekistan initiative began constructing housing across the country, with 1,536 apartments planned in Tashkent’s Sergeli district.

For New Tashkent, nearly 20,000 hectares in the Yukorichirchik and Urtachirchik districts of Tashkent region have been allocated. The first phase will include housing and infrastructure for 100,000 residents over 2,500 hectares.

CMWP experts note a shift in consumer preferences, with apartment size becoming less critical. Over the past two years, the average apartment size has decreased by 50%, now averaging 65 square meters.

"To address the housing deficit, accelerated construction of economy/comfort-class housing outside the city is needed. Population growth also requires qualitative changes in housing to meet the needs of highly qualified professionals," CMWP concludes.

Social Infrastructure

CMWP highlights high accessibility to primary and secondary education in Tashkent, with over 90% of children living within one kilometer of public schools. However, schools face staff shortages, inadequate teaching materials, low IT usage, and high workloads, with many operating in two shifts. Private schools make up 3–7% of all educational institutions. Including private schools, accessibility rises to 94%.

The situation with kindergartens is worse. Only 68% of children live within 500 meters of the nearest kindergarten. Private kindergartens account for 45% of all such institutions. Accessibility issues are particularly acute in private housing areas.

Tashkent also lacks medical facilities, modern diagnostic and treatment equipment, and specialized doctors. Projects such as a $100 million modern medical complex by India’s Aakash Health aim to address these gaps. The government has allocated around 30 billion sums ($2.44 million) for medical equipment, and efforts are underway to digitize healthcare services.

By 2030, Tashkent is planned to become five times greener, with parks and green spaces expanding from the current 900 hectares to 5,000 hectares. In areas with few green spaces and dense low-rise construction, summer temperatures exceed 35°C, while the northeast, with its botanical garden and low-density development, remains cooler.

Engineering Infrastructure

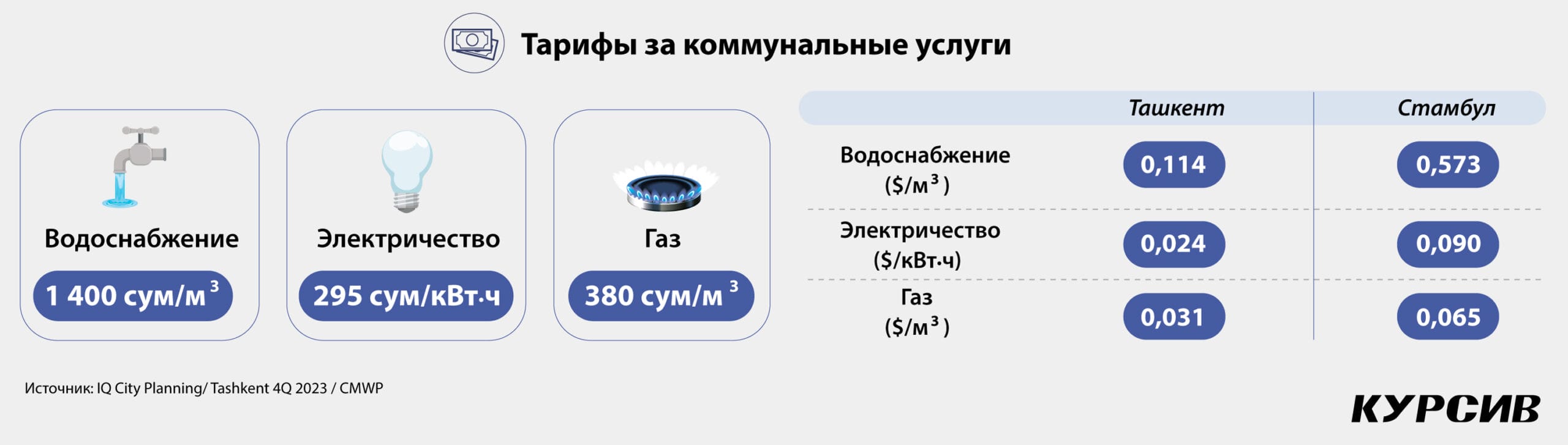

The extensive growth of the city is disproportionate to the capabilities of its outdated infrastructure. The wear and tear of engineering networks, insufficient maintenance, and ineffective management lead to frequent breakdowns, malfunctions, and disruptions in system operations. To address the issue, CMWP experts, drawing on global practices, recommend that city authorities increase utility tariffs.

"In engineering infrastructure, the ability to maintain the systems plays a crucial role. The annual budget depends on the revenues of resource-supplying organizations. A high proportion of non-payments or low tariffs affects infrastructure maintenance. Currently, there are objective challenges in concluding concession agreements, primarily related to regulatory and tariff issues," CMWP experts note.

French company SUEZ has been engaged to develop master plans for water supply and sewerage systems. For New Tashkent, a trigeneration plant—the first of its kind in Central Asia—is planned to provide heating in winter and cooling in summer.

Transport

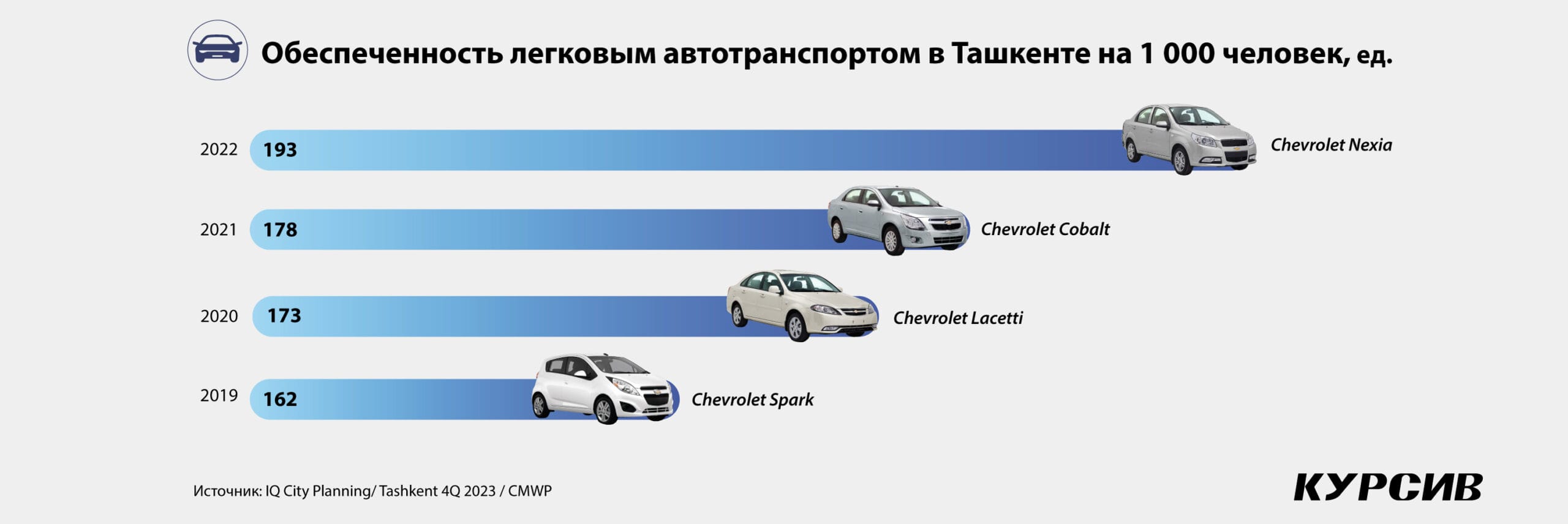

The number of cars in Tashkent has increased by a third (+34%) over the past four years, driven by population growth and improving living standards. By 2025, the number of cars is projected to grow by 120%, reaching 1.29 million.

The rise in the number of cars in Tashkent leads to traffic congestion, overloaded roads, insufficient parking, and negative environmental impacts. According to Commonwealth Partnership, worsening traffic conditions call for optimizing traffic flows, expanding the capacity of road junctions, and introducing restrictions in the city center.

"In global practice, various approaches and methods are used, such as congestion charges for entering city centers or paid parking, combined with the development of public transportation," states the *IQ City Planning Tashkent* report.

The authorities aim to double the use of public transportation in the capital from the current 30% to 60% by 2030.

"We believe that shifting residents to public transport is an extremely challenging task given the current structure of the city, and success will depend on a combination of factors: service reliability and quality, brand recognition, and changes in residents' consumer habits," CMWP warns.

Alexey Letunovsky, Head of the Analytical Group at Commonwealth Partnership Uzbekistan and author of the IQ City Planning Tashkent report.

In my opinion, the construction of New Tashkent is neither good nor bad—it is a necessity. Tashkent is a magnet for Uzbekistan’s population: it offers higher salaries and more opportunities. Considering the high birth rate and migration, the demand for housing in the capital will only grow, peaking in 15 years when today’s children enter the workforce and start forming families. If new land for residential construction is not allocated soon, developers will exploit every available plot in the capital amid high housing demand.

It is difficult to assess the quality of the New Tashkent project’s implementation, as there is no publicly available information. So far, it is known that there is a master plan (which is also not publicly accessible) that is not tied to a cadastral map. The vision looks promising, with plans for main and auxiliary roads, a tram network within the new district, and metro lines connecting the new polycenter with the existing city. However, in practice, only 20–50% of what is outlined in master plans is typically implemented. The development of regulatory documentation for the project is scheduled to begin in 2024.

Project transparency is crucial. The development of residential and commercial real estate in New Tashkent cannot proceed without informing investors. Moreover, residents will not buy apartments there without understanding the area's development prospects.

Another important issue is project financing, specifically the availability of partners willing to participate in a public-private partnership (PPP) model. Without such partners, implementing the project will be challenging.

Source: Kursiv Kazakhstan

Photo: Shutterstock